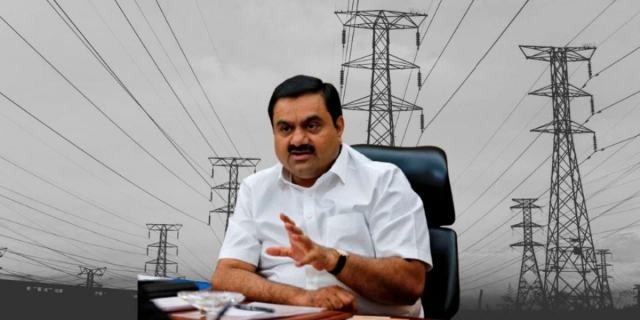

The billionaire chairman of the Adani Group in India Gautam Adani has been charged in New York for his involvement in an alleged multibillion-dollar bribery and fraud scheme.

US prosecutors have leveled serious charges against Adani, his nephew Sagar Adani, and seven other defendants, alleging a sophisticated scheme involving approximately $265 million in bribes to secure lucrative government contracts anticipated to generate $2 billion in profits over two decades. The comprehensive indictment encompasses multiple layers of alleged misconduct. Beyond bribery accusations, prosecutors claim that Adani and former Adani Green Energy CEO Vneet Jaain orchestrated the raising of over $3 billion in loans and bonds while deliberately concealing corrupt activities from investors and lenders.

The intricate nature of their alleged conspiracy is emphasised by the use of coded communication, with co-conspirators reportedly referring to Gautam Adani using pseudonyms like “Numero uno” and “the big man.” The legal proceedings involve multiple jurisdictional complexities. Defendants face an array of charges, including securities fraud, securities fraud conspiracy, wire fraud conspiracy, and violations of the Foreign Corrupt Practices Act. The US Securities and Exchange Commission has also initiated a parallel civil case.

While none of the defendants are currently in custody, arrest warrants have been issued for Gautam and Sagar Adani, with prosecutors intending to collaborate with foreign law enforcement. This development arrives at a particularly sensitive moment for Adani, whose personal net worth stands at $69.8 billion, positioning him as the world’s 22nd-richest individual and India’s second-wealthiest person. The timing is especially notable, occurring shortly after Adani’s $600 million green bond issuance and his recent announcement of a $10 billion investment in US energy infrastructure projects.

The allegations echo previous scrutiny faced by the Adani Group, most prominently the 2022 Hindenburg Research report that precipitated a $150 billion stock market decline. The current indictment challenges Adani’s substantial business interests and international reputation. Political dimensions further complicate the narrative, with opposition figures in India accusing Prime Minister Narendra Modi of providing preferential treatment to Adani. Modi has categorically rejected such claims as “lies and abuses.”

In response to the US legal action, the Adani Group has issued a categorical denial, describing the allegations as “baseless.”